Updates from Letty – June 21, 2019

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

After 18 months, we unceremoniously wrapped up our last meeting in our temporary digs at the Community Center and return to a renovated City Hall next Monday. Join us as we formally re-open City Hall and dedicate the new Council Chambers and Court Room next Monday night at 6 pm, followed by our regular meeting at 730 pm.

It’s hard to top last week with hedgehogs, signings, groundbreakings, and rainbow flags. This week’s work session was all about senior tax relief and continued updates to the Comprehensive Plan. If you’re feeling deja vu – it’s not just you. These are both topics we’ve previously discussed and I wrote about extensively in older blog posts (did you remember what demographers think the Amazon HQ2 impact will be in Falls Church?) So I’m going to keep it short and sweet – I’ll provide links, call out new substantive updates, and note my new considerations.

Best,

Letty

PS – Last call for ideas for the name of the new downtown park!

What Happened This Week:

(1) Senior Tax Relief

- As you recall, we approved $390K total in the upcoming FY20 budget for the senior tax relief program, which is an increase of $108K to allow for an expansion of the program. The details of the expansion did not need to be finalized at budget adoption, so the recommendations were discussed this week again.

- The working group’s recommendations remained the same: a pretty extensive overhaul of the program to encourage more deferrals by removing the interest rate and bringing the income brackets, relief amounts, and asset limits in closer alignment to our neighbors’ programs. It also adds a provision for the “house rich, cash poor” situation – ie, if a senior owns a house greater than 125% of the median home value, then the senior would only qualify for tax deferral instead of abatement. This is a good summary of the changes to the program.

- We are scheduled to vote on the program changes in our next two regular meetings, so the changes can go into effect this coming fiscal year (July 1, 2019).

- Letty’s thoughts – as I wrote in the spring, I feel strongly that for moral, social, and fiscal reasons, expanding senior tax relief is the right thing for us to do. I encourage you to read my previous post if you would like to better understand my position. That said, one risk of the program changes – because so many dimensions of the program are changing – is not knowing exactly what the new participation rate will be, despite our best estimations based on past applications. My hope is that we are able to help more of the most vulnerable senior population in our community – some who may not have previously applied at all because they wouldn’t have qualified or the relief amount wasn’t worth the effort. However, that uncertainty on who will apply opens up some risk to the annual budget. Because we can’t legally cap the program’s expenses at $390K, I support close monitoring and evaluation after the changes are rolled out.

(2) Comprehensive Plan Update

- For the latest Comprehensive Plan draft chapters under revision: demographics and housing

- I last wrote about our demography trends and projections last November and March, which included some surprising trends like a decrease in the number of households with children and a projected population of 20K in 2045, with Amazon HQ2 contributing a net increase of 160 households or so.

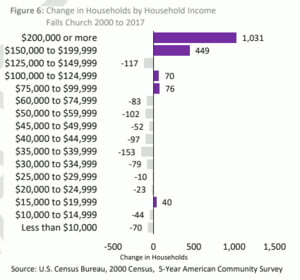

- Income inequality in Falls Church: not surprising, households with high incomes surged in the last 15 years. In the most recent draft chapter, we learned that the $200K+ income bracket has grown the most dramatically. Between 2000 and 2017, most household growth in the City occurred with households that have an annual income exceeding $200K. During this same time period the City generally lost households with income levels below $75k. As a result, about 4 out of every 10 households in the City has an annual income of $150K+

- Pages 15-18 of the updated Housing Chapter contain a lot of policy ideas and actions we could take on the topic of housing – everything from enabling granny flats and duplexes to providing more workforce housing to an increase in the meals tax to fund more affordable housing to starting first time homebuyer programs. In my opinion, this is the most important part of the Comp Plan – what initiatives or policy changes should we take on to support our vision of “housing for all”? (The actual, revised vision: create and maintain a diverse supply of housing that supports an inclusive and close-knit community… ensure affordable housing is available for a range of incomes, household sizes, generations, and needs.) While the survey for these housing ideas has closed, if you are passionate about the topic – take a look at those charts of ideas and tell me what you believe should be the most important.

What’s Coming Up:

- Monday, June 24 – City Hall Grand Re-Opening (6 pm, City Hall)

- Monday, June 24 – City Council Meeting (730 pm, City Hall)

- Monday, July 1 – City Council Work Session (730 pm, City Hall)

- Monday, July 8 – City Council Meeting (730 pm, City Hall)