Updates from Letty – January 28, 2022

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

This week’s post will be a bit different. Unlike most City Council meetings, the most important topics this week are unrelated to any votes we cast:

(1) The Fields apartments – this has been an increasingly frustrating situation, so I’ll share the latest and my thoughts.

(2) Fiscal Impact Model 101 – for those who have wondered how all the fiscal estimates are derived for mixed use projects, how those projects have actually performed IRL, or how it’s helped the city’s tax rate. This is one important tool we use in development decisions, but not the only.

(3) Continued good news at Founders Row and affordable housing

This coming Monday night, in lieu of a traditional meeting, we will meet in our retreat to map out priorities for the coming two years. It was great timing when the Falls Church News-Press asked me to author the guest commentary so I could both share my priorities and collect more community input before our retreat.

Best,

Letty

What Happened This Week:

(1) The Fields Apartments

Since October when city staff and the housing commission held a community meeting at The Fields apartments, the city has been trying to address residents’ concerns about their living conditions. This week during the public comment period of our meeting, we heard heartbreaking accounts from current residents about continued rodents, mold, and other issues inside the apartments. While some improvements have been made by the landlord/building owner, it clearly hasn’t been enough. City staff has been convening the city’s building officials and the Fairfax health department to step in. Besides new pest management companies hired for The Fields and small improvements, many issues persist.

Letty’s thoughts: This situation has been frustrating and completely unacceptable – the poor conditions have gone on too long and it’s our responsibility to help our residents. However, we learned that the city, in fact, has little legal authority to require the landlord to address the mold and that tenants have to directly take it up with the landlord. The landlord has also declined multiple invitations to come to a City Council meeting to address the concerns. (Hence, in this year’s legislative priorities for the General Assembly, we have joined other localities in asking to strengthen tenant protections and request more local government authority to help tenants in situations like this. It may be unlikely to advance given changes in Richmond.) We remain committed to helping our residents, so we will continue to escalate. I’ve requested regular reports from city staff and to coordinate outside legal assistance for residents until this is resolved.

(2) Fiscal Model 101 (and why you should care)

This week, we received a briefing following the latest “refresh” of the city’s Fiscal Impact Model with improvements and and updated inputs into the model. If you’ve ever wondered how the financial benefits of various projects are derived, how actuals have actually come in, or why we embarked on mixed use development 20 years ago in Falls Church – read on.

What is the Fiscal Impact Model?

- The model was developed in the early 2000s by consultants TischlerBise, with the intent to help the city better make land use decisions by projecting net fiscal impact, which is revenue generation minus operating impacts of a specific project. Since then, TischlerBise has developed similar models in other jurisdictions.

- This is different than economic impact analysis or the annual budgeting process.

- We run the Fiscal Impact Model for every mixed use project as one of the many considerations. Land use decisions are complex, and it’s not just about the fiscal impact to the city. We also consider factors like whether the project brings in important amenities to the city, adds benefits like affordable housing, and improves underutilized parcels.

- The model allows us to test changes through the development process – such as residential/commercial mix and service retail vs restaurant uses, as those factors will change the projected revenues and costs.

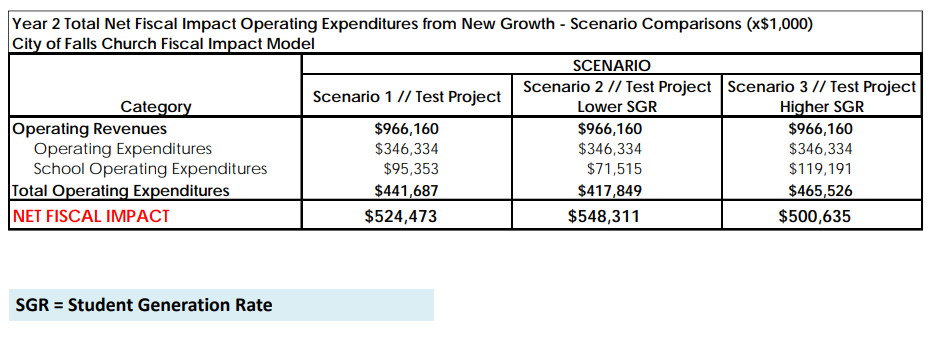

- The model gets refreshed and improved regularly with real operating costs of the city and other data, like student generation ratios (ie, the “where students live” annual analysis). The 2021-2022 updates include online sales tax revenue from new residents and ability to test +/-25% student generation ratios. Below is an illustrative example of the fiscal analysis showing revenues minus expenses, with the +25% high and -25% low scenarios and the net annual impact.

- The model isn’t perfect – for example, the model assumes 100% occupancy of the commercial spaces, which we know doesn’t happen immediately when a new project opens. That said, you may be surprised that Falls Church in fact has one of the lowest commercial vacancy rates in the region – in fact, staff reports that we had a 93% occupancy rate in the commercial spaces of our mixed use projects during the height of Covid-19.

How has mixed use development performed?

- In addition to the model updates, city staff also regularly analyzes actual performance of the 8 mixed use projects done to date and compares actuals vs the original projections. For 2020, all of the city’s mixed use projects generated a little over $4M in net annual revenue to the city. In real estate property tax terms – $4M in net revenue is equivalent to 8 cents on the property tax rate.

- Out of the 8 projects, 7 mixed use projects are net fiscally positive and all improvements from the revenues generated from those sites pre-development. Pearson Square is net fiscally negative.

How accurate are the model’s projections?

- 1 project occurred before the model was created so there was no original projection.

- 4 projects exceeded original projections.

- 3 projects came in below original projections. These are important opportunities to learn and improve the model. For example, at Pearson Square, the original model run under-predicted the pupil counts and since then, we have collected more data to generate more precise estimates down to the unit type and size. 455 at Tinner Hill (formerly known as Lincoln at Tinner Hill) is underperforming, but still net fiscally positive, due to a vacant restaurant space leading to lower revenues than the original model run.

(3) Good News Potpourri

Founders Row: Besides last week’s news about three additional restaurants coming to Founders Row, we received an update yesterday that the developer now has a signed LOI (Letter of Intent) for the movie theater at Founders Row. (As you may recall, the original theater operator declared bankruptcy in 2020 due to Covid closures.) A LOI usually outlines the general terms of a real estate transaction with agreement to proceed to the next step, but to be clear – it’s not yet a lease and therefore we’re not at the finish line yet – but this is promising news. What we know: they are a regional theater operator with strong finances and balance sheet, will be new to the DC region, they’re planning 8 screens and 750 seats with dine in.

Affordable Housing: Following a budget amendment this week to allocate funds from ARPA, the city (via the Economic Development Authority) closed on the purchase of another quadplex in Virginia Village yesterday, which will be the city’s 5th unit. A year ago, we had 1 quad under city ownership, so this has been a remarkable demonstration of our commitment to preserve affordable housing and to create future options.

What’s Coming Up:

Monday, Jan 31, 2022 – City Council Planning Retreat at 6 pm

Monday, Feb 7, 2022 – City Council Work Session*

Monday, Feb 14, 2022 – City Council Meeting*

*every Monday (except 5th Mondays and holidays) at 7:30 pm at City Hall and livestreamed. You can access the agenda and livestream here, including recordings of past meetings