Updates from Letty – April 11, 2025

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

After having the 5th Monday off last week, we resumed budget season with a lengthy midnight meeting. Read on for my highlights, including a regional picture of the impacts of the federal changes which is important backdrop for our budget. Our budget discussion this week was focused on capital projects, long range affordable housing funding, and then revisiting the solid waste issue – aka “how should we pay for trash services” discussion that I last shared in October. To be clear, the trash issue is mostly budget neutral – it’s about who should pay for the service. You may be surprised to learn that less than half of the city’s households receive city solid waste services yet the cost is spread across the entire city. Unlike other public goods like education where I believe everyone should contribute and can access it – multifamily buildings can’t get city trash and recycling. Read on and let me know your thoughts.

Our Accessory Dwelling update is up for a final vote on Monday. You can read my last post for a recap of how the ordinance has evolved over the past year, links to the staff reports for the most accurate information, and my thoughts. We continue to take public comments over email and virtually or in person on Monday.

Finally – with the wet weather today, I’m moving my walking office hours as part of the Falls Church Fitness Challenge to Friday, April 25, 9 am and 12 pm. I am still holding office hours today at 12 pm, but moving them indoors to Preservation Biscuit Company if you’d like to come by and chat about any of these topics or others. If you haven’t started your fitness challenge, it’s not too late – we could all use some movement and mental health boost!

Take care,

Letty

What Happened This Week:

(1) Regional Perspectives

We invited two regional bodies Metropolitan Washington Council of Governments (MWCOG) and Northern Virginia Regional Commission (NVRC) to discuss the latest info on the regional impact of the federal workforce changes, and this was before the tariffs chaos. This is important context for us as we deliberate on the budget and keep in mind impacts to employment and local economy and the risks to city revenues and projects or programs funded by federal grants.

You can see the full presentations here (MWCOG and NVRC), with these takeaways:

16% of the city and region’s workforce are federal workers, who are either impacted or threatened. This doesn’t include contractors or fed adjacent workers. Unemployment data is currently lagging and incomplete, which makes it hard to understand real time impact (hot off the presses data says the NoVA unemployment rate jumped up 7% in Feb). Available jobs posted have also dramatically decreased as private companies pull back. Finally, there is a large skill mismatch between federal workers and available jobs, making it harder for an impacted federal worker to easily find new employment.

What are we doing about this? I am in regular communication with my counterparts in the region and our federal delegation, so that we are sharing and coordinating response strategies, including joint advocacy for our residents and providing input on testimony on the General Assembly’s special emergency committees that are underway right now. We also are increasing safety net funding, knowing that we’ll have more residents who will need housing, rent, or other emergency assistance. The city continues to update available resources on the city website.

(2) Capital Improvements Program (CIP)

The CIP contains the large capital infrastructure projects that are over $150K with a useful life of 5+ years. In total, the 6 year CIP is about $148M, with 1/3 for general and school projects, 1/3 for transportation, and the remaining for sewer and stormwater projects. 1/3 of CIP projects are grant funded (with about $12M in federal grants) and the rest funded with a combination of debt and cash. We spent a long time discussing the projects underway and upcoming that use federal grants. The good news is that staff reports that so far, we have had no loss of federal dollars impacting CIP projects, although we remain cautious.This presentation is a good summary with the full CIP available on the budget website. Some key areas I probed into:

- Maintenance costs – I’d like to see maintenance costs better factored into the decision making for CIP projects. This is something I’ve asked for years. Often time, maintaining the new park or school will cost more money and that should be planned for in our operating budgets.

- School capacity – it’s notable there are no school capacity projects in the CIP at all. That’s because the schools project having enough capacity until 2045 (see page 220 of the schools budget)! That’s notable given how much investment we had put in school capacity with the expansion of Mt Daniel in 2018 and the new Meridian High School in 2021.

- Transportation safety, pedestrian improvements, traffic calming, paving have been top priorities of the community so I expect we’ll further discuss the funding for those initiatives.

(3) Solid Waste Funding Options

This week, we revisited the solid waste topic that has been a long-standing issue that we last discussed in October. I encourage you to read that post and this week’s staff presentation to get up to speed. I’ll share some key FAQs that I’ve been fielding:

Q: How do we pay for trash and recycling now?

A: Everyone who pays city taxes helps pay for trash because it’s built into the annual city tax base of single family homes, townhomes, condos, apartments, commercial buildings, etc. It costs $950K annually, with about 2/3 of the cost going towards the contract and labor and the remainder for tipping fees, ie how much waste we actually produce.

Q: Who receives curbside service?

A: About 3000 homes – single family homes and most townhomes – receive curbside trash and recycling service via the city. 582 households also use the Compost Crew curbside composting program, which is paid for by residents and heavily subsidized by the city, about $130 per household annually.

Q: What is the issue?

A: Over time, we’ve heard from more multifamily buildings residents that they pay for curbside trash and recycling service via their taxes, but don’t receive services. And they double pay via their rent or their HOA fees that take care of their building’s solid waste. (Unlike other city services – such as police, fire, library, education – which everyone has access to if you’re a resident but may or may not use, the city does not provide solid waste services to most multifamily buildings or commercial mixed use.) Staff has presented a number of options on how to address this issue – from converting the service in the tax rate to a flat or variable fee only for those who receive services to changing the service model to include multi family buildings. The latter option has not been recommended by staff as we have 20+ multifamily buildings, some with commercial mixed use and some without, and buildings have existing contracts with private waste services already. It’s also notable no other jurisdictions have chosen to service multifamily or commercial buildings.

Q: Why change it now?

A: In recent years, we have diversified our housing stock such that we have more multifamily apartments and condos (4K) than single family homes and townhomes (3K), so the “equity issue” is growing bigger. We’ve had some residents advocate for a change for 30+ years.

Q: How do other jurisdictions pay for solid waste?

A: It varies. Our bigger neighbors like Arlington, Alexandria, Fairfax pay for it via a fee and small jurisdictions like Vienna and Herndon pay for it out of the tax rate. (Letty’s note: our housing stock is more similar to our bigger jurisdictions, with more commercial and multi family than our small jurisdiction peers.) Also important to note than some parts of the region don’t even get municipal solid waste and neighborhoods/streets will contract their own private service.

Q: How can we encourage less waste?

A: As part of the 20 year solid waste management plan we just adopted (see my May 2024 post) and other climate goals – we are committing to reducing our waste. Two options have been discussed to address this policy goal:

One way is to a variable fee, a “pay as you throw” model, where different size trash bins have different costs to encourage people to dispose of less. (Letty’s note: on paper and 6 months ago, I was a fan of this model because it should incent people to reduce consumption and make less waste, as households who produce more waste will pay more. However, as I’ve mulled it, it’s quite complex operationally and may be difficult to implement and ensure fidelity.) Another way is to introduce a 3rd bin – make composting available to all who get curbside services, for yard waste and food scraps, instead of the current subsidized option. By bundling it into the solid waste program, the service is more cost effective (adding $22 per household), more people would compost, resulting in more organic waste going to compost and diverted from landfill.

Q: If you give me a 3rd bin, do I have to compost?

A: No, you don’t have to compost. Just like when recycling was introduced 30+ years ago, it became part of the bundled service. There is no mandatory requirement for individuals to recycle or compost, but I hope that if we make it part of the curbside offerings, more people will try it out and adopt a new habit. (Because we backyard compost, I can attest that it does divert a lot from the landfill! We only drag our bins out every other week even in a household of 5.)

Letty’s Thoughts:

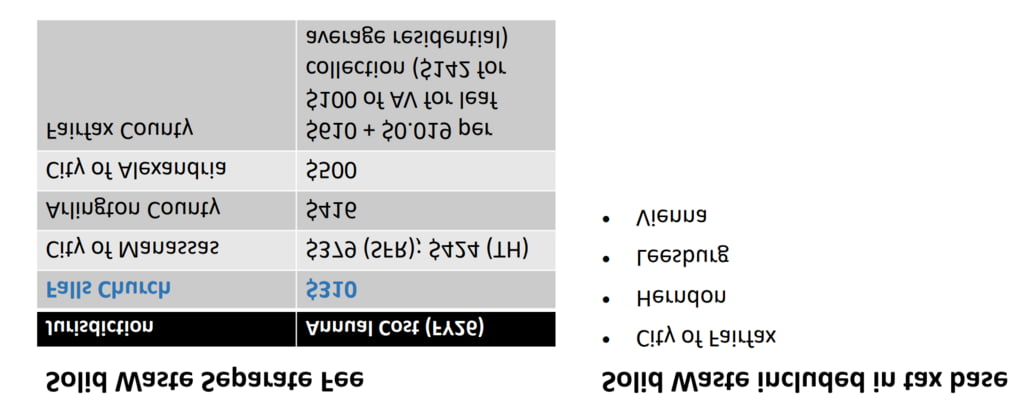

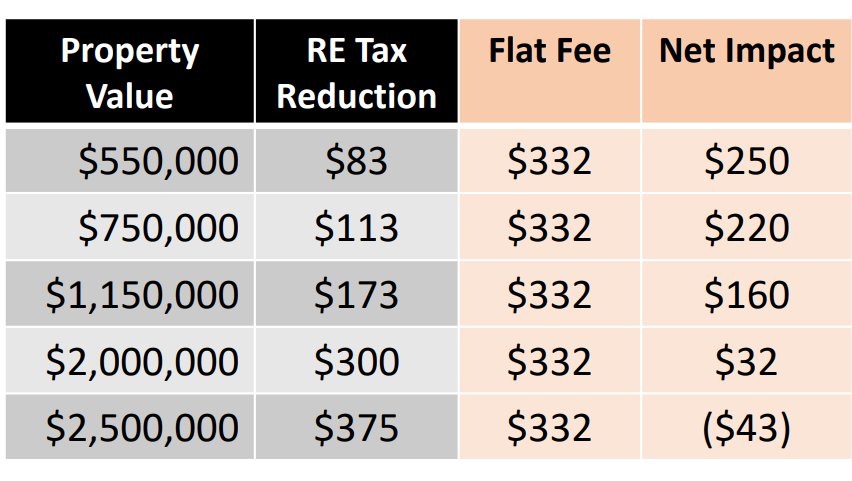

I would like to fix this fairness issue in this budget cycle and believe changing to a fixed fee, while not perfect, would be the simplest way to address this long standing issue. This issue gets more complicated to fix every year that passes because the imbalance will only grow. I also believe we’ve piloted curbside composting with heavy subsidization for enough years that uptake is flattening out – in order to divert more waste, it needs to be offered as a service across the city. In the fixed fee option, we would take the $950K cost out of the tax rate (about a 1.5 penny tax cut). For 4K multifamily households and commercial buildings that don’t get service – they would see a 1.5 cent tax rate cut and no further fees. For the 3K homes that receive city curbside service, they would see the 1.5 penny tax rate cut and a flat fee for solid waste service, including a new 3rd bin for food scraps and yard waste, which is estimated to be $332 total per year.

Depending on your home value, the net impact of the tax rate cut + new fee will vary. That originally gave me pause, but I saw that 2/3 of the cost of the service is a fixed cost regardless of household size, size of home, or how much trash is generated by that household. In other words, it takes mostly the same amount of labor to pick up trash and recycling from a $750K home as a $2M home. As such, I have gotten more comfortable with the idea of a flat fee.

As the Council was split on how to proceed, we are waiting to hear if the Treasurer can implement this change in time for the December 2025 tax bill as well as considerations like how this would impact the schools’ revenue sharing model (Letty’s note: I would support holding the schools harmless so their expected revenues aren’t impacted) and other questions and answers before we gauge whether there is support to proceed.

What’s Coming Up:

Monday, April 14 – City Council Meeting* (final vote for Accessory Dwelling ordinance)

Monday, April 21 – City Council Work Session*

Monday, April 28 – City Council Meeting*

Monday, May 5 – City Council Work Session*

Wednesday, May 7 – Ask the Council Office Hours (9 am, City Hall)

Monday, May 12 – City Council Meeting* (final budget adoption)

*Mondays (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings

Letty’s Office Hours:

Friday, April 11 – 12 pm (Preservation Biscuit Company)

Friday, April 25 – 9 am AND 12 pm (Walking Office Hours – meet at Broad St entrance of Howard Herman Trail)

Wednesday, May 21 – 5 pm (Walking Office Hours – meet at Cherry Hill Park)