Updates from Letty – February 23, 2024

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

Wow, I should have known last week’s post about the proposed West Falls mural would have elicited a lot of comments! Thank you for the input. While we’re on the topic of art, have you seen the newest mural at the Eden Center? To close out Black History Month, the early spring weather next week is a great time to check out the city’s African-American history and art on the Art Walk – look for the Zig Zag sculpture at the historic Tinner Hill site, the Hope for Tomorrow mural, and more.

From our work session this week, I’m going to highlight (1) the latest demographics report and projections – understanding our demographics and how they are expected to change guides our planning across housing, transportation, recreation, facilities, and more. And (2) ahead of budget season, I’ll share the city’s most recent financial results and why I think surpluses aren’t necessarily great.

As a quick reminder: I’m holding my February office hours today! Come see me this morning at The Happy Tart at 10 am. I’m happy to hear from you about the topics above or upcoming votes, including final consideration for the proposed Quinn/Homestretch redevelopment project at next Monday’s meeting. We also take official public comment by email or in person or virtual testimony at our meetings.

Best,

Letty

PS Take note that we have a town hall meeting next Tuesday, February 27 about the Greening of Lincoln project if you are a neighbor or just interested in the project.

What Happened This Week:

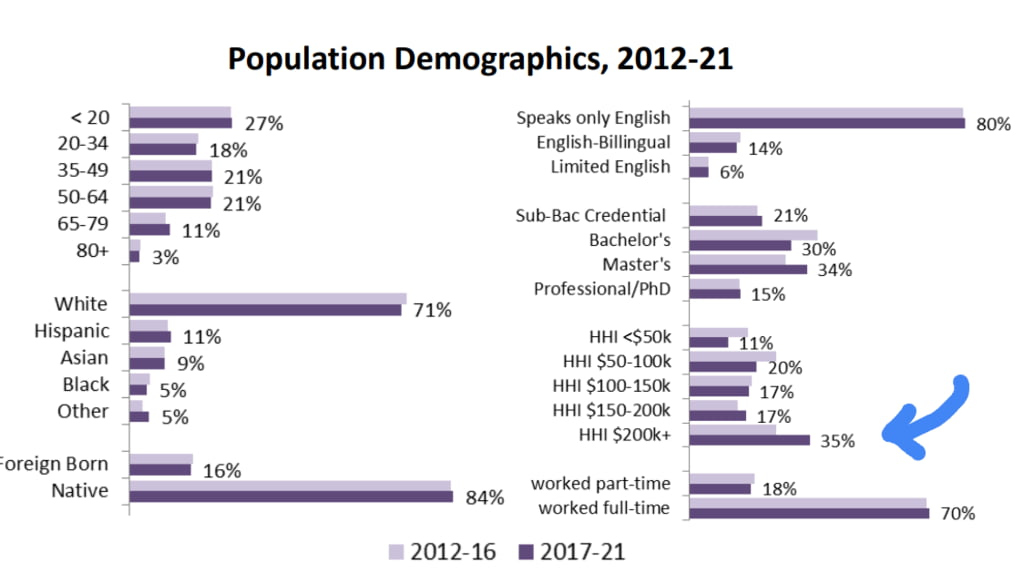

(1) Demographics Update

If you’re a new reader, the city’s Comprehensive Plan (Comp Plan) is a long range planning document, with an overarching vision across different topics, including economic development, natural resources, parks and recreation, transportation, and housing. Chapters within the Comp Plan get updated on a rolling basis. The “People, Housing, and Jobs” chapter was last updated 5 years ago. Understanding our demographics and forecasts in population, housing, and job changes helps us plan for future needs. We collaborated with the Steven Fuller Institute at GMU on a demographics study and school forecasting, which we heard in our joint meeting a few months ago.

Highlights:

- Current population: about 14,600 residents – which largely remained stable during the pandemic.

- Housing stock: 6,500 housing units, about 1,000 of which have been added in the last 10 years. These new units are housed almost exclusively in large, multi-family dwellings as the supply of single-family homes and townhomes remains flat. As of 2022, over half of housing units in the City (3,600 out of 6,500) were multi-family.

- Jobs: as of Q4 2022, there were approximately 8,900 private sector jobs. Largest sectors: Education and Health Services (24% of jobs); Trade, Transportation, and Utilities (17%); Leisure and Hospitality (16%); and Professional and Business Services (19%).

- Key changes:

- Wealthier, more educated residents now compromise a larger share of the population. This economic shift outpaces nearby Fairfax County: between 2012-16 and 2017-21, the City’s median household income grew by 35%, more than double that of Fairfax (17%)

- Falls Church is a desirable residence for families with kids, with 36% of homes occupied by households with children in 2017-21 (up from 31% in 2012-16).

- The City’s desirability—and a limited stock of single family and large multifamily units—has meant increased home values.

- 25-26% of homeowners are cost burdened (7% severe) while 35% of renters are cost-burdened (15% severe)

- Looking ahead: In the next 10 years, Falls Church can expect to add 42% more housing units, 21% more residents, and 18% more jobs.

Letty’s Thoughts:

Understanding our population and where they’re going is critical – we should be answering “who is here now and what are their needs” and “who will be here and what are their needs”. I think it’s also important to look at broader trends and contrast with our neighbors – as that gives us a glimpse into “who wants to be here or stay here, but can’t” due to our housing supply. Also – one of the biggest wildcards to any future projections is the evolving work environment post-Covid. For many jobs, I believe it matters so much more where you live vs where you work, and Falls Church can be a great place for the hybrid. We can develop strategies to grow and retain start up and small businesses and cultivate more entrepreneurship – more to come.

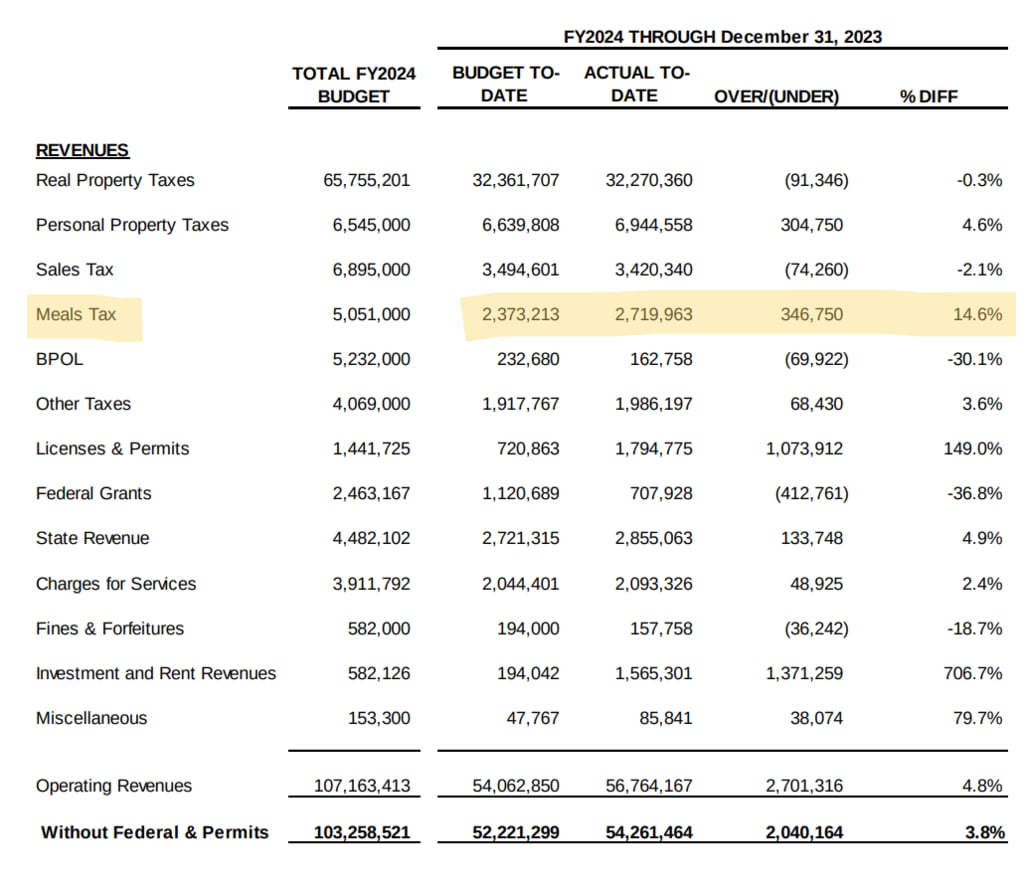

(2) Q2 Financial Results

- TL;DR: overall, the revenues are over budget by 3.8% (about $2M) for the first six months of FY2024, primarily due to increase in investment income (aka higher interest rates), personal property and meals taxes. With expenditures under budget by 0.9% (about $1M), it results in a current surplus of $3M.

- The full financial report for Q2 is available with a few highlights I’ll pull out:

- Tax relief for the elderly, disabled, and veterans have come in for $107K more than what has been allowed for in the budget.

- Assessed values of cars are still continuing to increase particularly for new vehicles.

- Sales tax revenue is lagging behind projections by 1.6%, although with almost

4.9% year over year growth. Tax from both the groceries and online sales are up, by 5%

and 20% compared to last year respectively. Sales tax is one of the key local economic

indicator and staff continues to monitor it. - Meals tax revenue has experienced significant growth and exceeded the budgeted target

for the year by 14.6%, which is about 17.7% over the second quarter of last fiscal year. - Other Taxes are 3.6% ahead of budget primarily due to improved hotel taxes, which

have recovered to over 80% of pre-pandemic levels. - Building Permits revenues are significantly over budget due to collections from major projects underway, which funds building safety operations for new construction underway.

Letty’s Thoughts:

Two thoughts:

- In contrast to our neighbors who are facing high office vacancies that drag down their revenues, we have a pretty rosy local economy – and that is great news. And on the surface, a $3M surplus halfway through the current fiscal year also seems like good news. But surpluses are one-time money and generally can’t be used to fund ongoing operating expenses like teacher salaries, sidewalk maintenance, or tax rate cuts. And to be fair, revenue forecasts have been tough during Covid and post-Covid trends. We’ve been discussing the revenue forecast for the upcoming budget year (about to kickoff with the presentation to City Council on April 1), which will be more aggressive to minimize ending the year with surpluses.

- While real estate taxes make up about 60% of the city’s revenues, local taxes like sales and meals taxes combined are about 10%. They’re a great indicator of the health of the local economy and one of the best ways residents can directly contribute to the city’s finances. While it’s too soon to see the results from our Restaurant Week, we continue to exceed expectations with meals taxes – keep supporting our local restaurants!

What’s Coming Up:

Monday, February 26, 2024 – City Council Meeting*

Tuesday, February 27, 2024 – Greening of Lincoln Town Hall

Monday, March 4, 2024 – City Council Work Session*

*Mondays (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings